The Indian equity markets will remain open on February 1, 2025, due to the Union Budget 2025. Historically, the budget prioritised strategically essential areas such as defence, infrastructure, railways, and agriculture. Key equities to monitor are HAL and BEL (Defence), RVNL and IRCTC (Railways), PSUs (SBI, LIC), EMS companies (Dixon Technologies, Amber Enterprises), and agriculture companies (Coromandel International, RCF).

The equities markets will be open on Saturday, February 1, when the Union Budget for 2025 will be announced. The special budget session will provide investors and traders the opportunity to respond to the budget statements.

Budget releases have a favourable or negative impact on individual sectors or businesses, causing market volatility. Traders and short-term investors seek to capitalise on this volatility, with some employing derivatives such as options and others focussing on stocks.

Here are important industries and equities that will be in spotlight on budget day.

Defence sector

The defence sector has been a focus in several budgets, with increasing spending and upgrades to current sources. Every year, the defence sector receives certain budgetary announcements. Here are major equities from the defence sector that will be in spotlight on budget day.

Stocks include Hindustan Aeronautics Ltd, Bharat Electronics Ltd, Garden Reach Shipbuilders & Engineers, Bharat Dynamics Ltd, Cochin Shipyard, Data Patterns, Apollo Micro Systems, Astra Microwave Products, and MTAR Technologies.

Railways

The Indian railways sector has experienced significant upheaval in the last decade, following the government’s decision to improve the quality of India’s main passenger travel option. Finance Minister Nirmala Sitharaman is expected to increase railway capital investment by 15-20% in the Union Budget 2025, perhaps lifting the overall allocation to above ₹3 lakh crore.

Stocks include Rail Vikas Nigam, IRCTC, IRFC, Railtel, IRCON, Jupiter Waggon, and Titagarh Waggon.

EMS players

The Indian government is anticipated to continue to support electronic manufacturing services (EMS) companies through a production-linked investment scheme. According to media sources, the government is set to unveil a ₹25,000 crore PLI plan for electronic component producers and ₹43,000 crore for semiconductors.

Stocks include Dixon Technologies, Amber Enterprises, PG Electroplast, Kaynes Technologies, and Epack Durable.

Also Read:

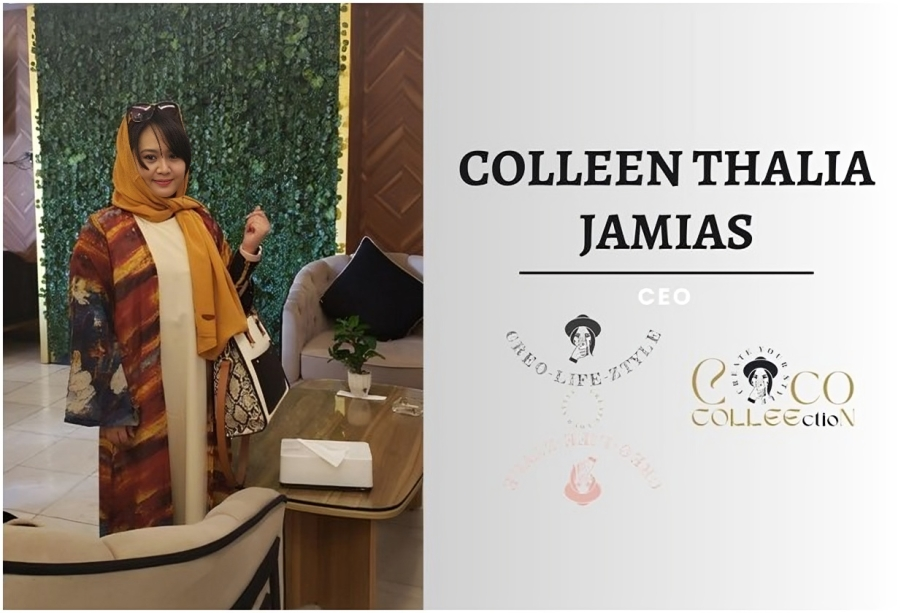

Empowering Women Worldwide: The Story of Colleen Thalia Jamias of Creo LifeZtyle & COCO COLLEEctioN